Factory Construction Boom May Pull US Economy Out of Crisis

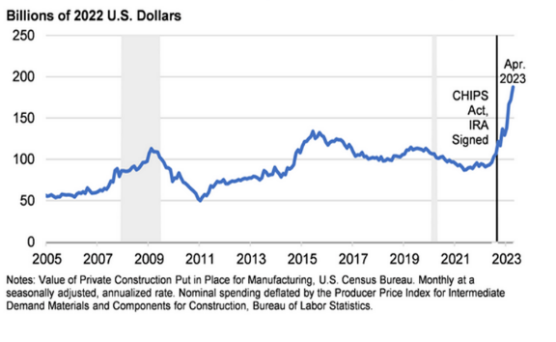

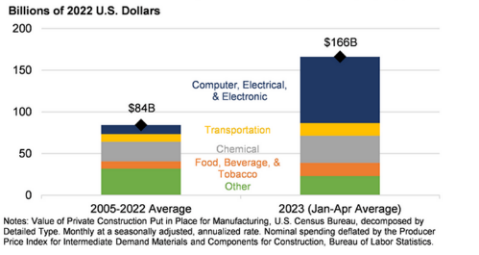

Spending on construction projects for manufacturing plants in the US has almost doubled over the past year in real dollars, reports the US Treasury Department (see Figure 1).[1] It appears that the US may be returning to an emphasis on manufacturing. Treasury says, “The boom is principally driven by construction for computer, electronic, and electrical manufacturing” (see Figure 2), for example, semiconductors. The Treasury attributes the boom to supportive Biden administration legislation: “the Infrastructure Investment and Jobs Act (IIJA) [signed Nov. 2021—Ed.], Inflation Reduction Act (IRA) and CHIPS Act [both Aug. 2022] each provided direct funding and tax incentives for public and private manufacturing construction.” But we at The Communist also point to US involvement in the Russia-Ukraine war as a principal stimulus of the manufacturing construction boom, for manufacturing companies are building plants to fulfill new weapons orders requiring “computer, electronic, and electrical manufacturing.” Another reason is the movement since the Trump administration to reverse the “offshoring” of US jobs and manufacturing: “reshoring” is the new trend.

If the factory construction boom is real and not just hype, it may explain the surprising development that US inflation has receded in the past year though the Federal Reserve Board (hereafter, “the Fed”) has not raised its interest rates above the rate of inflation, the usual requirement for taming inflation and the one employed by Fed chief Paul Volcker in bringing down the rampant inflation of the 1980s. Inflation that was as high as 9.1% last year has declined to 3.2% though the Fed raised rates only as high as 5.25%. In this period, the factory construction boom, already taking off, was injecting real value into the economy; moreover, the anticipation of increased manufacturing output may also have contributed to calming inflation.

As of August 2023, the Fed’s program of increasing interest rates—now holding at the highest rates in 23 years (5.25%)—has strangled annual price inflation down from last year’s high of 9.1% to 3.2% as of July 2023.[2] Happily, the strangulation of credit has not had much effect on jobs, except to slow job growth, especially in manufacturing[3] (though that may turn around with the factory construction boom). At the same time, wages are going up, though not enough to make up for inflation. In July, actual average hourly earnings by “production and non-supervisory employees” rose at an annual rate of 5.5%,[4] after workers were starved by last year’s 9.1% inflation. Nonetheless, Fed chair Jerome Powell says that with inflation coming down, “real wage growth has been increasing.”[5] With interest rates higher, home sales have plunged. In July 2023 actual home sales were down 18% versus a year ago, and mortgage applications also fell which mean sales will fall further next month.[6]

With inflation down near 3% at no cost to jobs, it would seem the crisis of 2021-2022 is over. Why hasn’t the Fed lowered interest rates?

First of all, inflation is expected to accelerate later this year. [7] July’s 3.2% increase in the consumer price index (CPI) was the first acceleration in CPI inflation rates since June 2022. The reason for this is that “core CPI” is now increasing faster than the CPI overall. “Core CPI” increased 4.7% in July, higher than the 3.2% increase in CPI overall, and Powell expects it to accelerate more.[8] Core CPI is a measure of underlying inflation that excludes the prices of food and energy products, which gyrate wildly in both directions, says Wolf Richter. “Core CPI” reveals the actual state of affairs: more inflation to come. In addition, energy prices which had been falling, are now on the rise again. Their decline since June 2022 had masked CPI increases. Now that energy prices are on the rise again, they are driving up the CPI.[9] So, Powell is considering another interest rate hike.

We showed in the last issue of The Communist how prices in the USA are lower than they should be due to (imperialist) exploitation of raw materials and labor from other countries.[10] For example, the US Army has been stealing oil from the Syrian Arab Republic since at least 2019, 14.5 million barrels in the first half of 2022, approximately 83% of Syrian output.[11] “We’re keeping the oil, remember that. We want to keep the oil. Forty-five million dollars a month,” said President Trump in 2019.[12] The Army is also stealing wheat. These commodities enter the US market, whether directly or through the Army, and lower US prices for comparable goods as a result. So, from 2009 to 2020 annual inflation remained below 2.5% per year. In fact, from 1992 to 2020 inflation didn’t go above 3.8% per year.

The US is also looting Europe. Serbian President Aleksandar Vučić told Tucker Carlson “that the war in Ukraine, the NATO-led war against Russia, has destroyed the economy of Europe, that the Biden administration’s destruction of Nord Stream is directly or indirectly destroying the German economy, Europe’s largest economy. The consequences of one NATO country effectively attacking another are being felt across Europe,” Carlson paraphrased Vučić’s remarks.[13] As a result, over the first half of the year [2023], 50.6 thousand German companies have already gone bankrupt, Zeit Online reported.[14] A preliminary survey showed that in August 2023 German business activity contracted at the fastest pace for more than three years. The HCOB German Flash Composite Purchasing Managers’ Index, compiled by S&P Global, fell to 44.7 from July’s 48.5, hitting its lowest since May 2020 and confounding analysts’ expectations. A reading below 50 means recession.[15] In the European Union, sanctions against Russia have “killed European competitiveness,” shrinking the EU’s share of global GDP to just 17% – five points down from where it was in 2010, said Hungarian Foreign Minister Peter Szijjarto at the Bled Strategy Forum in Slovenia in August 2023.[16]

All this looting of foreign economies causes problems. One result of wrecking the German economy, the former economic powerhouse of Europe, is that Russia’s economy has surpassed Germany’s in size (see Table 1). The simultaneous reemergence of Russia as a world power threatens to cut off US access to raw materials around the world (e.g., Africa, Middle East): the expectation of that happening will raise prices in the USA. This does not mean inter-imperialist rivalry as some have claimed is the nature of the US-Russia relationship. Rather, Russia is simply defending itself and its allies, such as Syria and Ethiopia.

[1] https://home.treasury.gov/news/featured-stories/unpacking-the-boom-in-us-construction-of-manufacturing-facilities/; and also https://wolfstreet.com/2023/09/03/construction-spending-for-factories-soars-after-decades-in-the-doldrums/#comment-540375/

[2] https://tradingeconomics.com/united-states/inflation-cpi; https://wolfstreet.com/2023/08/10/end-of-disinflation-honeymoon-cpi-accelerates-yoy-core-services-cpi-accelerates-mom-durable-goods-prices-normalize-at-nosebleed-levels/

[3] https://wolfstreet.com/2023/07/07/long-view-of-job-growth-by-industry-some-gained-jobs-at-others-jobs-got-crushed/

[4] https://wolfstreet.com/2023/08/21/powells-inflation-nightmare-job-seekers-incl-the-employed-suddenly-expect-massively-higher-wages-in-job-offers/

[5] https://wolfstreet.com/2023/08/25/powell-smacks-down-calls-to-raise-2-inflation-target-2-is-and-will-remain-our-inflation-target/

[6] https://wolfstreet.com/2023/08/22/home-sales-plunge-further-as-demand-vanished-at-these-prices-even-cash-buyers-pull-back-supply-keeps-rising/

[7] https://wolfstreet.com/2023/08/10/end-of-disinflation-honeymoon-cpi-accelerates-yoy-core-services-cpi-accelerates-mom-durable-goods-prices-normalize-at-nosebleed-levels/

[8] https://wolfstreet.com/2023/08/25/powell-smacks-down-calls-to-raise-2-inflation-target-2-is-and-will-remain-our-inflation-target/

[9] https://wolfstreet.com/2023/09/05/gasoline-prices-rise-year-over-year-for-first-time-since-feb-2022-cpi-inflation-to-feel-the-heat-this-year/

[10] Daly, Dr. Robert, “Where There’s Smoke, There’s Fire” in The Communist Vol. 2, 2022, pp. 62-63.

[11] https://morningstaronline.co.uk/article/w/us-occupying-forces-steal-more-80-cent-syrias-oil-ministry-says/; https://english.news.cn/20220817/437cb1bd33ea40999cda96c521f31d21/c.html/

[12] https://www.bbc.com/news/50464561/

[13] https://t.me/Slavyangrad/59622

[14] That’s 12% higher than the same period last year.

[15] https://t.me/rtnews/46647/

[16] https://www.rt.com/news/582058-eu-bad-shape-hungary-ukraine/